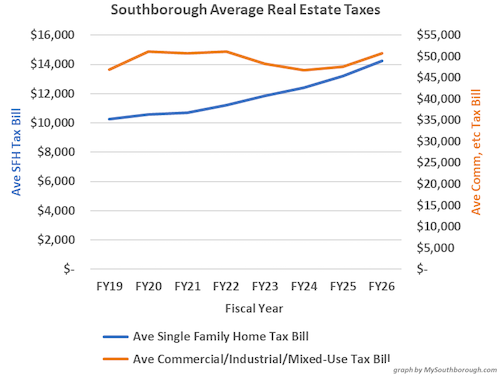

Above: Residential Tax bills have continued to increase over the past few years. Percentage increases for the average commercial/Industrial property have been less steep, but they are also on the rise. (graph based on data in Town reports and presentations)

In a hearing last week, the Assessor estimated that bills for an average Single Family Home in Southborough will increase by 7.6%.

That’s up slightly from the 7.37 –7.47% increase projected by Town officials last spring before Town Meetings.

In the November 4th Tax Classification Hearing, the Select Board voted 4-1 to stick with a “single tax rate”. Based on that decision, the Assessor’s formula calculated the rate to be $14.36 to cover the Town’s tax levy in 2026.

An average Single Family Home will see an increased property tax of $1,008, split over four quarters. (That doesn’t include the CPA surcharge.)

In his presentation to the Select Board, Assessor Paul Cibelli highlighted a continued decrease in “New Growth” as contributing to home owners’ tax burdens.

In his presentation to the Select Board, Assessor Paul Cibelli highlighted a continued decrease in “New Growth” as contributing to home owners’ tax burdens.

The change is also partially due to the continued increase in average home values, especially beyond the increase in commercial property values.

The average single family home appraised value for FY26 is $991,000 (as of last January). That’s about $7K more than was used by officials in their tax models before Town Meetings last spring.

What it means for homeowners

Actual impacts will vary as home valuation changes can vary widely each year.

When the preliminary valuations for this Fiscal Year were posted this fall, I reached out to Cibelli with a question. He informed me that the Town saw a recent spike in values for split level and ranch houses. (His educated guess was that was caused by Southborough having so few “entry level” homes versus other nearby communities.)

To learn more about checking on your own updated home value, click here. (The Online Property Cards are still showing outdated data from FY25 assessments.)

To calculate your FY26 property tax, multiply the assessed value by 14.38/1,000. (The amount paid for the preliminary FY26 bill that was due on November 3rd will be deducted as a credit from the total owed for the fiscal year.)

Presentation on Tax Situation & Splitting Rate Debate

During the hearing, Cibelli focused much of the presentation on bringing the newest Select Board member, Tim Fling, up to speed. That included explaining that one metric that looked positive is also unreliable.

The assessments for taxable Personal Property rose by 9.56%. Cibelli explained that unlike real estate, those values will depreciate over time. Plus, businesses can quickly pull and relocate those assets.

The Assessor highlighted that he doesn’t expect the New Growth situation to improve in FY27. There aren’t many new homes being built, and there’s an expected “lag” before commercial projects (like Costco) and 40Bs in the pipeline become taxable realities.

Cibelli also detailed to Fling his, and the BOA’s, position against adopting a split tax rate for residential and commercial/industrial properties. His arguments included the value businesses add to Town finances and opposition to “driving a wedge” between residents and businesses.

Fling asked what the Assessor would think about implementing a small change in split rates that would get “ramped up over time”.

Cibelli responded that would be a “Pandora’s Box” that ends up increasing to 10-20%. He cautioned that when towns rely too heavily on the commercial taxes, a crash in their values has a magnified impact on the overall tax base.

Fling rebutted that is already what Southborough is experiencing. Cibelli told him the situation is “much worse” in communities with split rates. He worried about having too many eggs in one basket.

Echoing a point Cibelli made, Select Board member Kathy Cook later stressed that saving a resident 10% on their tax bill would require increasing commercial tax bills by 60%. She followed,

We just don’t have enough commercial businesses to be able to even think about doing this.

It’s worth noting that the Commercial/Industrial, Mixed-Use are on the rise again, even if less steeply than residential taxes. The average tax bill for that property class will go up by 6.76% (or $3,214.)

In the end, only Fling voted against the single tax rate.

Below are more charts from the Assessor’s presentation (which you can open here). I also added a couple of my own updated charts.

The above information explains HOW the tax burden pie is being sliced, i.e. your piece of the tax pie, based on a hypothetical number: your assessed value.

Worthy of discussion are several big ACTUAL numbers, THE OVERALL SIZE OF THE TAX PIE ITSELF, i.e. how that tax burden pie ballooned over the past few years. And separately: TOTAL EXPENDITURES. The increases can be summarized in one word: UNSUSTAINABLE.

Just a few short years ago, the total tax levy was roughly $50m. It is roughly $60m at present. That’s a $10m increase over just a few years.

That said, even more alarming is the increase in actual expenditures and projected expenditures. According to the April 2025 Advisory Report to Annual Town Meeting (see link below), FY 2024 expenditures were $61.5m. The same report estimates expenditures for FY 2026 at $69.4m, an increase of $7.9m A MERE TWO YEARS LATER!

Click here to read the full report.

The Select Board knows the town budget and expense situation is hitting the proverbial fan.

This explains a lot with regard to recent actions of the Select Board to “restructure” government and to possibly try to “adjust” elected positions and transition to a “representative” form of government. They want control. Thank goodness, the voters rejected Article 10 and indefinitely postponed to form the SB’s sketchy committee to transform town government.

Why on earth would voters hand over their voice at Town Meeting and control to an SB that can’t do basic math. Spending is OUT OF CONTROL and expenses need to be cut, directly and indirectly as much as possible. Keep your eye on the bouncing ball to be sure that your voter rights are not diminished in any way, with a possible re-emergence of this vague committee — while your wallet is being picked. The 7.36% increase in taxes projected in the spring is now 7.7%. This entire situation is unsustainable.

I agree that we have an unsustainable business model. The total FY 25-26 operating budget, net of debt, has grown to $63.4 million from the FY 23-24 budget of $56.4 million a 12.5% increase.

I will focus on the parts of municipal government that are under the control of the Select Board as those the only ones that I have some modest (very modest) influence on. The Select Board is responsible for about 30% of the overall operating, non-debt, budget. The Select Board is not responsible for the Schools, Library, Planning Department, Health Dept, Assessors Dept, and Town Clerk. Our org chart is a mess.

Regardless, the Select Board needs to set its own house in order. Of the $19 million of the operating budget the Select Board is responsible for, about $14 Million or 73% is for labor costs, both salaries and benefits (benefits cover both current and retired workers). Municipal headcount over the last 10 years had increased by 14.3%, our population has only increased by about 6%. This is a significant driver of the our budget increases. Something has to change and the Select Board should not kick the can down the road any further. The Select Board should at a minimum vote on the following actions (so that the voters can know where each member stands). All of these actions are completely within the Select Boards authority:

1. Departmental Consolidation – To describe municipal government as siloed is an understatement. It is more like fortresses, surrounded by bastions and moats. Each year the “small departments” are given a pass in the budget negotiations because they are too small to cut. Cross training is limited and each department has to have its own administrators and clerks. Consolidation would begin to improve productivity and allow for more efficient deployment of resources.

2. Prior approval of Open Position. – Today, if any hiring approval by the Select Board is required, it is after the fact. In effect the board is given the opportunity to vote on an offer that has already been made. This is process is, frankly, insulting to the board which is treated as a rubber stamp. When a position is open, the board should vote as to whether the position should be filled. A review of the functions the position provides and a full justification should be made prior to authorizing posting of the position. This is very important because it will protect the jobs of the remaining employees, who will become more valuable to their departments.

3. Modernization of Business Processes – Our business processes are significantly out of date. Whether it is scheduling a meeting, posting an agenda, getting a dump sticker, or payroll we are not taking advantage of modern technology and processes. This has led to very inefficient allocation of our labor resources. We need a systematic review of what each administrative personnel spends their time on and to ask if there is a more efficient way to achieve the goal. Our Town Administrator and Department Heads should be expected to bring labor saving opportunities forward as part of their job function. If they can’t, we have a problem.

There are other things that can be done outside the purview of the Select Board but these are a start. It will not be comfortable. Change is like that, but it is necessary.

Over the next 10 years we are likely to face the need for adding significant debt as we deal with the Neary situation and the fact that our other schools are approaching 30 years old. In addition, it appears that our school populations may start to increase somewhat after 2 decades of decline. We cannot continue operating the antiquated inefficient system we now have. Voters in the next 2 years will probably be asked to approve a Prop 2.5 operating override. They should say NO until our municipal government takes the steps to bring our operations into the second quarter of the 21st century and out of the 20th.

Some towns allow the voters at town meeting to follow suggestions made by boards to reduce a budget such as Library, health dept. ,Planning, and even school. Imagine that, the citizens of the town can vote to reduce money allocated from their taxes to different departments.

I’m confused by your comment. That is allowed at our Town Meeting as well and has been done – but is rarely approved by the hall.

Karen, the cumulative official inflation rate over the last four years has been something close to 20%, so on balance that’s not too bad. Kudos to the SB for keeping it in line! Al’s point about the head count is far closer to the real situation. But more to the point, if you’re so discontented with the way the town is being run why are you so opposed to a committee to evaluate changes to the way the town is being run? What would you do differently?

It is certainly admirable that Mr. Cibelli, Southborough’s Town Assessor, remains so steadfastly confident that the growing number of Massachusetts communities with 80% of the state’s commercial development are wrong to adopt split tax rates. His unwavering support for maintaining one of the highest residential property tax rates—higher than 87% of all residential properties in the state—is, in his view, justified in order to preserve a commercial property tax rate that is lower than that imposed on 72% of the commercial property in Massachusetts.