[Ed note: My Southborough accepts signed letters to the editor submitted by Southborough residents. Letters may be emailed to mysouthborough@gmail.com.

The following letter is from Carl Guyer]

To the Editor:

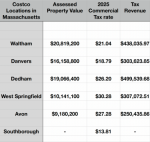

The prospect of Costco establishing a new facility in Southborough presents an excellent opportunity to illustrate how the town’s current commercial real estate tax policy affects municipal revenue. In 2024, Southborough’s residential property tax rate was higher than that paid by 87% of homeowners across Massachusetts, while its commercial tax rate was lower than that applied to 72% of commercial properties statewide. This imbalance significantly limits the revenue Southborough derives from its commercial sector. The following table compares commercial tax rates for existing Costco locations across Massachusetts to highlight this effect.

As the comparison shows, regardless of the valuation ultimately assigned by Southborough’s assessor, the town will “miss the boat” on realizing the full revenue potential that a new Costco could generate. With 78% of the commercial property in Massachusetts within split tax rate communities, these results are hardly surprising. As noted earlier, the potential Costco development simply underscores a broader issue — Southborough’s comparatively low commercial tax rate limits the town’s ability to capture the financial benefits that similar projects deliver elsewhere.

Carl Guyer,

146 Middle Road

Carl, where were you able to pull each of these numbers from? Did they all come from the same source or did you have to pull each one from the town in question? Sorry to be pedantic but I’m an academic and we get all bent out of shape about citations.

No problem, here is what you do.

First use Google to find the locations of the Costcos in MA.

Then Google “Mass GIS”. This will bring you to an interactive map with data on each lot in the state. In the search field paste in the address for each Costco. Click on the data box that appears and you will find the assessed value for the location.

Next Google “Mass DOR Data Bank”. This will bring you to a data base of the tax demographics for all the communities in Massachusetts. Follow the menu and you can find the residential and commercial tax rates for each of the communities with a Costco.

Good luck, I appreciate your interest.

FYI – Notice for the Tax Classification Hearing where the Select Board will vote to set the tax rate(s) for FY26 was posted today. It is scheduled for Tuesday, November 4, 2025 at 7:00 pm. It will take place during the Select Board Meeting (and a joint session with the Board of Assessors) in the Town House Hearing Room, with zoom access..

Carl,

What you have provided is interesting. Originally, I planned to vote for the Costco development, given our Town’s tax situation. However, this morning I woke up wondering whether it would harm any small businesses in the area. (Now that we are almost empty nesters, it’s unlikely that we would actually shop there…). Its proposed location at the intersection of 495 and 9 would likely attract residents from adjacent towns, but is that what we would like for our Town?)

I noticed that your list includes cities like Dedham, Waltham, etc., places that clearly are not comparable to Southborough. Does that factor into the equation at all?

The proposed development appeared out of the blue one evening at a Select Board meeting, and most people seemed to immediately think that it might be an answer to our prayers. And maybe it is, but are there any potential downsides?

Any thoughts? Thank you.

Diane Romm

Diane

Any time a new competitor enters a market there will be disruptions. But I think you are asking the wrong question. We are not voting for Costco or no Costco. We are voting for Costco in Southborough vs Costco somewhere else in MetroWest.

I think it is safe to assume that Costco has done its homework and has determined that MetroWest is a desirable market. If we were to say no, then some other MetroWest community would jump at the opportunity. Westborough, Hopkinton, Northborough, Marlborough all have exits on 495. All would like the tax dollars generated.

So, yes there will be winners and losers. There is no guarantee that Costco will be successful (but I would not bet against them). I am sure that BJ’s in Framingham, Northborough, and Berlin are not too happy. I suspect that Stop and Shop in Framingham and Westborough are not as well. Julios in Westborough and Total Wine in Framingham are also probably not happy.

In town, we do not have a grocery store so that is not a concern. There is some concern from package/convenience stores in town. I can’t say their concerns are not real but their business models are quite different.

At the end of the day, some time in 2027 or 2028 there will be a Costco in the greater Metrowest area. The only real question is will it be in Southborough or somewhere else.

“So, yes there will be winners and losers. “…. Sure, but changing the rules for the benefit of a specific player is just unfair.

Thank you for your thoughts. And a Big Y apparently just opened in Westborough! From the limited research I did on Costco, I am inclined to believe they did conduct their market research, like you mentioned. (I wonder if the Amazon grocery store proposed for the former Barnes & Noble is still a go.)

Obviously I am a little concerned about a large, congested area developing….. Route 495 already looks like the MA Pike with the amount of cars and trucks now traveling it.

I guess it is what it is….