This week, the Board of Selectmen closed the Warrant on the 2019 Annual Town Meeting. The meeting is scheduled to open Saturday, March 23*. My update is “rough” because a lot of details are still sketchy. But it also looks like this could be a tough meeting for officials and voters.

As I posted previously, Selectmen have been struggling to balance Town services vs fiscal restraint with potential tax hikes. At the December 4th meeting, Treasurer Mark Ballantine blamed a reduction in a state reimbursement (SBAB) for a chunk of the potential tax increase. Other factors include insurance and funding for future employee benefits.

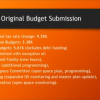

Those are in addition to needed capital expenses and budget increases. New expenses include debts for the Public Safety building, Golf Course, Recreation projects and Library building expenses. (You can click on the image right for a high level overview.)

Ballantine told the board that he’s always hearing from departments “residents want”. He said in a vacuum he’s sure it’s true that there are residents who want services expanded in each department but “you can’t”. He said if you do, you’re just expanding services and “not fixing the problem . . . there are some years you just have to maintain what you have.” He forecasts a tight belt being required for the next 2-4 years.

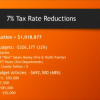

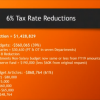

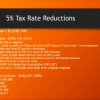

Town Administrator Mark Purple followed that all of the budget requests made were good ones individually. But put them together and they don’t fit. At the board’s prior request, the Treasurer showed them what would be sacrificed if the FY20 budget was capped at a at 5%, 6%, and 7% tax increase. You can see those slides below. (Click here for the full discussion.)

Chair Lisa Braccio opined that a 5% cap would be irresponsible and unsustainable. Based on the high percentage of budgets dedicated to salary and the required annual salary increases, and the capital expenses needed she doesn’t see how they can sustain service to taxpayers at a lower than a 6% increase. Based on overall feedback circling around 6.5%, Purple said they would work towards a 6.2-6.3% cap to leave a little room for items still unknown in early January. (The state’s education budget, etc.)

On Tuesday, Purple updated that suggested revisions to initial budgets were sent departments. The team is now working with them to flesh out new bottom lines. Purple said that departments were being very collaborative.

On January 10th, the board will hold a meeting dedicated to hashing out the budget. The Administration and Finance team will present its detailed recommendation with all department heads invited.

Selectwoman Bonnie Phaneuf instructed that budget objections by departments/committees should be submitted in writing by two days before the meeting. She asked to avoid individual complaints that night that lead to going round and round.

The board turned down a request by the Advisory Committee to make the 10th a jointly held meeting so they can ask questions. Braccio pointed out that Advisory already had a chance to question each department. This is the selectmen’s turn. They plan to hold a subsequent joint “roundtable” meeting with Advisory. (Advisory will still be invited to attend the 10th.)

Of course, the budget isn’t the only thing voters will be asked to decide at ATM. Town Administrator Mark Purple said there was potential for up to 50 Articles. But it’s likely the final count will be lower.

In fact, one citizen’s petition may be a moot point by the time meeting comes. A non-binding resolution would apparently ask selectmen to form a committee to talk to nonprofits that own land in Town to increase their PILOT** payments. Phaneuf said there is no reason to wait for an ATM vote. She suggested proactively creating an Ad Hoc committee and recruiting three volunteers to work on it. She asked to start putting feelers out. (Stay tuned for details on that. But anyone interested could ask to be in the loop by emailing selectmenoffice@southboroughma.com.)

The draft Warrant in the packet included about a dozen citizen petition articles. Last minute additions not listed included more still being verified. Others additions were requested “placeholders”. The draft was already dominated by placeholders and incomplete articles. Expect the board to re-open the Warrant at least once for updated language later this winter. But it will likely be closed in the same motion to avoid adding new articles.

Based on the date in the draft, I assume that the language needs to be finalized by February 19th for official posting. (Articles can still be amended on the floor.)

Some articles not listed in the draft include having Southborough designated a “Tree City” and a potential article for implementing a meal tax. (Though, there didn’t seem to be enthusiasm for the concept, the majority of selectmen said they were willing to discuss it.)

Purple described a new citizen’s petition as a red flag policy for identifying fraud in Town government and the school system. And a placeholder was added following a request for selectmen to enact municipal restrictions/prohibitions on 5G rollouts in town. Since the board is unauthorized to enact ordinances, it would need to be a bylaw. Purple is following up with the Cable Committee’s attorney to ask how he is advising other clients on 5G issues.

This year, the Moderator will be able to employee a new consent agenda that allows bundling non-controversial items for quick passage. Any article that a voter asks to hold would be pulled out for separate discussion. The first 20 articles are mostly administrative matters including the budget, capital expenses, annual authorizations, and personnel bylaws. In some years those have passed quickly. In other years, presentations and debates have dragged some out.

*The draft Warrant in the packet stated the meeting would open at 7:00 pm. But I assume that was a typo held over from past years. The article passed last May specified a 1:00 pm Saturday start.

**PILOT=Payments in Lieu of Taxes

The data from the 2018 fiscal tax year is now available at the Mass DOR website. Things have not changed since last year. Residents in Southborough are again paying a residential tax rate that is greater than that paid on 78% of the residential property in Massachusetts while our commercial property owners have the advantage of a tax rate that is greater than that of only 25% of the commercial property. Members of our Economic Development Committee say this is “fair”. I disagree.

We should hire the Selectmen from Andover, a community with demographics nearly identical to ours, and have them put together a plan that would save the average tax residential payer $1,000 to $2,000 annually by splitting the tax rate as they do in Andover.

You cannot run a efficient organization without keeping up to date on revenue generating opportunities.

“You cannot run a efficient organization without keeping up to date on revenue generating opportunities.”

Carl – Leaving aside the split tax rate issue, this statement is questionable at best. There is no reason to believe that Town Government is efficient or that the powers that be have any particular interest in efficiency. Indeed, it has been far easier to raise taxes than to ask critical questions about the efficacy of our operations. That would require change.

Our local government will not even begin to think about operating in a more efficient fashion until Town Meeting applies pressure by not supporting never ending tax increases.

Why change when the voters telling you there is no need to change?