Above: The EDC’s 2016 report paints a rosy picture of Southborough’s “growing economy”

Southborough’s Economic Development Committee recently released its 2016 Annual Report. The report summarizes the work EDC has done over the past year and its positive outcomes.

The document is one more tool that markets Southborough to businesses. But it also promotes to resident taxpayers the benefits to the Town’s economy.

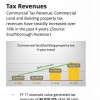

For instance, the report tells businesses that Southborough offers the 4th lowest single tax rate in the MetroWest region. Meanwhile, residents will be happy to know that property tax revenues from Commercial Land/Buildings have steadily increased over 16% in the past 4 years.

Residents may also be happy to learn:

- Industrial vacancy rates continue to drop to an all-time low of 1.1%

- In 2016, Southborough welcomed 40 new (or re-established) companies, creating over 100 jobs

- Unemployment was down by .5% in 2016 from the year before.

Efforts by the EDC last year include:

- Worked with over 30 companies on technical assistance to identify business assistance needs and development opportunities

- Launched biannual Broker Breakfast Series to create partnerships between real estate, developers, municipal and community leaders to keep commercial vacancies low and encourage redevelopment of underperforming commercial properties.

- Asisted Boroughs+ Working Group to develop and host the “Last Mile Summit” with keynote Lt. Gov. Polito on transportation and commuting issues in the area.

- Created and released first Shop SOBO Local Business Directory

- Championed and developed Best Practices Model for Streamlining the Local Permitting Process (a guide to be published in 2017)

The EDC also touted efforts to support development projects at three properties. Two are about new development:

- Supported Trask Development of 337 Turnpike, over $2M private investment

- Collaborated with neighboring municipalities and developers on a potential site development for a large pharma company 155,18 SF LEED certified project at 0 Firmin Ave.

But the last bullet was also provided the year prior, highlighting the slow movement of a project at the site where Genzyme once sat. While another “highlight” seems to be an attempt to cast a silver lining on a cloud. A business headquarter that was once a source of pride for Southborough continues to lay vacant.

Kaz, Inc. is the manufacturer of appliances with brand names including Vicks, Braun, PUR, Febreze and Honeywell. As of 2014 it purportedly represented 125 Southborough jobs. But in 2015, the company relocated to Marlborough despite the EDC’s and Town’s outreach efforts. The EDC has been attempting to help attract a new business to the site since then.

The 2016 report states:

- Maintained regular contact with owner of former Kaz location at 25 Turnpike Rd to promote leasing or redevelopment of site.

And yet, those properties probably stand out precisely because the Town’s vacancy rates are low. So, I’ll end this post by congratulating them on the decreasing vacancies and rising commercial property tax revenues.

You can see more details cropped from the reoport on those stats (and more) by clicking the thumbnails below:

To see their full 2016 Annual Report, click here.

I would be interested in knowing how the EDC calculated a commercial land and building property tax revenue of increase 16% over the past four years. I checked with the Massachusetts DOR Data Bank which records city and town data related to property tax collection. The data from the DOR from 2013 to 2016 says that the total property tax levy for Southborough went from $34,209,424 in 2013 to $37,119,053 in 2016. The residential portion went form $27,598,776 in 2013 to $29,927,721 in 2016 for an increase of 8.44%, The commercial/industrial/ tax revenue went from $6,610,648 to $7,119,053 for an increase of 7.69%. That is the data Southborough reported to the State of Massachusetts according to the DOR online Data Bank.

The stats are for fiscal years FY14-FY17. Our Town’s fiscal years run from July 1 to June 30. The report says the data came from the assessors office.

*** Update ***

I found the data in the EDC report used to calculate the 16% increase in commercial and industrial tax revenue. What is immediately noticeable is the tax revenue stream reported by the EDC from the commercial tax base is over a million dollars lower than the typically reported CIP tax revenue. The apparent explanation is that the EDC used only 2 to the 3 categories of commercial assets generating tax revenue in their calculation. Between discrepancies in the town and state data (3 %) and use of only two categories of commercial revenue stream (another 3%), you can explain why the data available on the state web site reports a 10% increase in commercial tax revenue between 2014 and 2017. As with the previously reported 2013 through 2016 data, the change in residential tax revenue is the same as the commercial tax revenue at 10%. The two general categories of residential and commercial tax revenue have changed over the past years at the same rate according to the date reported to the state. It is odd that the EDC data is in agreement with the state data in 2017 and 2016, but differs by 3% in 2015 and 2014. I cannot explain the difference.