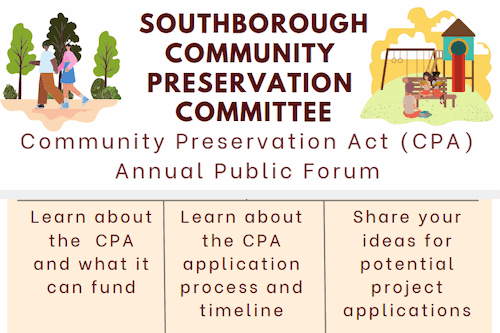

Above: The CPC’s annual forum is in a couple of weeks. (images cropped from flyer)

Each year voters at Annual Town Meeting decide whether or not to support projects using money collected through the Community Preservation Act (CPA) surcharge.

If you’re thinking about bringing a proposal forward or want to ask questions/provide feedback before the next funding cycle opens, mark your calendars. The Community Preservation Committee (CPC) is holding its annual public forum two weeks from tomorrow.

The forum is an opportunity for interested community members to learn more about what the CPA fund can cover and the application process.

The forum is an opportunity for interested community members to learn more about what the CPA fund can cover and the application process.

It’s also a chance for the public to ask questions and voice opinions, propose ideas on what kinds of projects they would like to see funded/prioritized. You can even propose ideas for specific projects.

At the public forum on June 18th, CPC members will explain the timeline and process for applying for CPA funds for the next funding cycle. They will also answer questions from participants — including those who join by zoom rather than attending in person.

Although Town Meeting 2026 may seem like a long way off, the process of vetting proposals and preparing Articles takes time. Applications are typically solicited the summer prior.

The meeting starts at 7:00 pm at the Public Safety Building, 32 Cordaville Road with the option to attend virtually. (The zoom link will be posted here.)

Below is a primer for readers looking for more context around the CPC and CPA.

In 2003, Southborough voters adopted the option to add a CPA surcharge on top of property taxes. The surcharge is 1% of the property taxes on the value of the home after the first $100K.1

Those funds, along with partially matching funds from the state, are used for projects that meet specific criteria under the law. Those projects must “serve a public good” and fall within the following uses:

- The acquisition, preservation, or creation of open space

- The acquisition, preservation, rehabilitation, or restoration of historic resources

- The acquisition, preservation, or creation of land for recreational use

- The acquisition, preservation, creation, or support of community housing (affordable housing)

It’s worth noting that for that for affordable housing projects, Town Meeting recently transferred a big chunk of CPA funds to the Affordable Housing Trust. That gave the AHT board members more flexibility to pursue housing projects without having to wait for Town Meeting approval.2

For all other projects, Town Meeting ultimately decides how Southborough’s CPA money gets spent. But the CPC first reviews projects (for eligibility under state regulations, project viability, funding availability, etc). They then vote on which, if any, projects to bring to Town Meeting voters (and the Article language).

In recent years, there was some public debate about whether the CPA surcharge should be reconsidered. At this time, I’m not aware of anyone actively pursuing changes. Even if a change was sponsored by Town officials, it would require voters’ approval.3

You can learn more about the CPC and the history of the CPA in Southborough here.

- There are surcharge exemptions available for low income residents. You can read about the calculations and exemptions here.

- You can read about the affordable housing fund administration here. And you can find info on what the AHT board has been working on through their agendas and minutes here, and view recordings of their public meetings here. (Some closed Executive Sessions are exempt from public requirements under Open Meeting Laws.

- There have been varying opinions expressed by members of the Select Board, Advisory Committee, and CPC public meetings about whether to keep the 1% surcharge to pay for worthy projects that otherwise wouldn’t be funded, bring a question to voters to give them the option to eliminate the surcharge to reduce their tax bills, or even to ask voters to up the surcharge to 3% to increase the state’s contribution towards funding needed projects with the hope of ultimately lowering burdens on Southborough taxpayers.