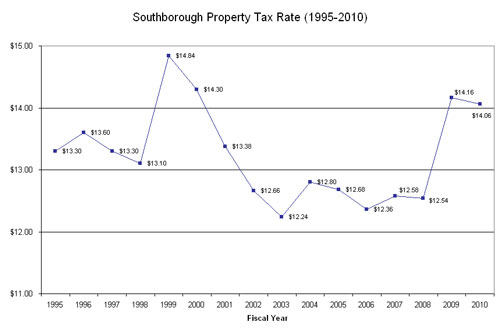

Last week selectmen set our property tax rate for fiscal year 2010 at $14.06. That’s a tad lower than last year’s rate of $14.16. But Principal Assessor Paul Cibelli warned that we might see a significant increase in the tax rate next year.

At town meeting last April we voted to use a one-time cash injection of approximately $700K to keep the tax rate low. And it worked. Problem is, that cash most likely won’t be available again next year, which means chances are good the tax rate will go up in fiscal year 2011.

How much will it go up? That’s anyone’s guess, but history might give us some indication. The town took a similar strategy in 2008, using free cash to offset the property tax rate. The following year, the property tax rate increased by a whopping 9%.

From the chart, it looks like the same thing might have happened in1998-1999, but I’m not sure. Anyone recall?

Unemployment is at 10%, homes in Southborough are in foreclosure, many residents have seen their incomes and assets decline, seniors dependent on Social Security got no increase this year. The New England Economic Project, a group of economists suggests that Mass employment will not return to 2008 levels until 2013. The idea that we must engage in a knee jerk tax increase is cruel.

There is substantial inefficiency and waste in the way our local government organizes itself to deliver important services. There are also significant untapped pools of funds ($millions) already collected by town government that can be released to provide relief to hard press tax payers.

Until we deal with these important issues we should be expecting tax cuts not increases.