Above: The Select Board meeting had a good turnout last week. A number of the attendees were there for the Select Board’s decision on consolidating retiree health benefits. (images cropped from meeting video and MSHG and Aetna communications)

Last week, the Select Board voted to shift from offering retired Town employees 5 health plan options to just one. The consolidation is expected to save money for both the Town and the retirees while offering better benefits. But some former employees publicly worried that the pitch is too good to be true.

Here are more details about the coming changes followed by highlights from the discussion with public commenters upset about the change.

What’s Happening?

The change, effective January 1st, only applies to retirees on Medicare. (Apparently, those who don’t qualify for Medicare receive health benefits under the Town’s plans for active employees.)

The Select Board approved entering a contract for an Aetna Medicare Advantage Plan through the Mass Strategic Health Group for a one year term. A member of the Town’s Insurance Advisory Committee*, assured they will start looking at how the new plan is working six months in, so they can evaluate if changes are recommended for the next year.

Next month, the Town’s benefit plan advisors (NFP) will host a meeting for retirees to introduce them to the plan and answer more questions in advance of the change. As part of the deal, plan members will also have free access to an independent “Concierge Service” (RetireeFirst) to help them navigate any coverage issues. Select Board member Al Hamilton also pushed them to ensure that the service is made available ASAP.

An NFP rep** highlighted that outside of retiree costs for the Town plans, retirees have to pay Medicare B premiums. Those will be going up $175 per month next year. Given that increase, they were looking for a way to ease the burden. According to Insurance Advisory Committee member Ryan Donovan, if the Select Board didn’t approve a change, the members would have seen a 7-8% increase in plan costs next year. (After meeting multiple times this year to investigate the options IAC voted unanimously to recommend the consolidated plan.)

According to Finance Director Brian Ballantine’s memo, the change to the consolidated plan is a win-win:

This change would save the Town about $90,000 annually while the retirees would save about $195,000 annually given many members move from 50% to 25% contributory shares. This would also result in a lower administrative burden and would maintain the same if not better offered benefits.

To read Ballantine’s memo with supporting documents, click here.

Among the plan benefits, is the inclusion of a “SilverSneaker” program, that covers membership to certain fitness programs. At least four of the five current plans don’t include that benefit. The new plan also eliminates provider networks, which are sometimes a problem for members, especially those that moved further away.

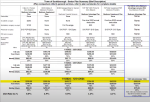

Answering a question about why they didn’t include a second option, an NFP representative explained that it didn’t make financial sense, since the Advantage Plan terms were so good. A chart comparing the current plans and the new one indicated that under the new plan every member would pay lower monthly fees last year. Under each category of co-pays (for appointments and medications) the amounts were either the same or lower than all of the current plans.

Answering a question about why they didn’t include a second option, an NFP representative explained that it didn’t make financial sense, since the Advantage Plan terms were so good. A chart comparing the current plans and the new one indicated that under the new plan every member would pay lower monthly fees last year. Under each category of co-pays (for appointments and medications) the amounts were either the same or lower than all of the current plans.

NFP reps confirmed that any doctor who takes Medicare will take the new plan, billing under Medicare B. The consultants insisted that since members are already on Medicare, that means all of their current doctors must be covered.

Not all retirees were convinced. . .

Too good to be true?

Select Board member Marguerite Landry asked about the “too good to be true” concerns the board had been hearing. She wondered how Aetna could make money off the plan. There were several factors.

NFP reps explained that in addition to the payments received from employees and the Town, the Medicare Insurance plans are compensated by the federal government. The savings are also a benefit of greater buying power. When the Town was offering five options, the buying power for each plan was weak. Consolidating increased the buying power. And by negotiating through Mass Strategic Health Group, a collaborative of multiple communities, the buying power was even greater.

Select Board member Kathy Cook also pointed out that Aetna is a large national company versus some of the smaller local competition, and owned by CVS Caremark, which helps with the prescription cost savings.

A retired Southborough teacher said that she checked with six doctors she and her husband see (two primary and four specialists) and none take the plan.

An NFP rep explained that they just didn’t understand about billing it under Medicare and that a RetireeFirst Concierge would resolve it by walking medical offices through billing procedures.

The retiree also voiced concerns over joining Aetna. She claimed that Aetna’s star ratings were low (3.2 to 3.9) and that unhappy reviewers complained about high “refusal rates”. A doctor had told her that difficulty working with Aetna was why they no longer take that insurance.

An NFP rep said that the ratings would refer to the market rate plan and that they had been told ratings for this specialized off-market plan were high.

Bonnie Phaneuf, a former Select Board member, opposed not offering former employees multiple options as they had always offered them as active employees. She later asked if the Town was consolidating active employees’ benefits, too. NFP responded that under state law, the Town is required to offer at least two types of plans. At this point they aren’t looking to make a change.

Phaneuf argued that voting on a plan was premature. She highlighted that the retirees still hadn’t received a packet with all the plan details. Cook rebutted that the Town had taken a lot of time to vet it to find a better plan, and held three forums for retirees. She highlighted that member Sam Stivers had already mentioned that he spent the last 20 years in the healthcare business and that she advises people on the choices for a living.

Phaneuf asked what options she had if she refused the new plan. The answer was that retirees can pay for a Medicare supplement out of pocket. If they choose to come back to the Town plan, the open enrollment period would be for the following year.

A few other former employees raised their concerns about Aetna and the lack of choices. In contrast, former Public Health Director Paul Pisinski said that he supported the change, and looked forward to the Silver Sneakers benefit. (Pisinski clarified that he doesn’t have healthcare expertise. Back when he was director, his position was focused on septic/sanitation issues and healthcare was left to the nurse. The department’s responsibilities have expanded in recent years.)

*I reached out to Brian Ballantine for more information about the Insurance Advisory Committee. The “informal” committee represents workers and retirees on the Town insurance plans, and works with the Town Administration to make recommendations to the Select Board. It is comprised of representatives from each of the groups on the plans: Retirees; Salary Administration Plan (non-union employees); and unions for the Schools, Fire Dept, Police Dept, DPW, and Communications Officers (although that seat is apparently vacant). To read more about it, click here.

**NFP was represented at the meeting by Rusty Short and Ken Lombardi. (Unfortunately, since the video screen was taken up mostly by a document, I couldn’t identify which of them was speaking throughout the presentation and comments.)