I keep hearing warnings about Southborough’s fiscal position and upcoming tax rate increases.

Selectman John Rooney has repeatedly sounded the alarm on the need for the town to control expenses. He warns that our property taxes will continue to grow in the coming years if we don’t take necessary steps.

There has been some heated debate on this site about how to handle the tax problem. But it’s been dominated by just a few commenters.

I assume many readers are like me. You are somewhat concerned, but have been lacking context. I did a little research and got some information from an old friend.

Here is a quick overview to get you up to speed.

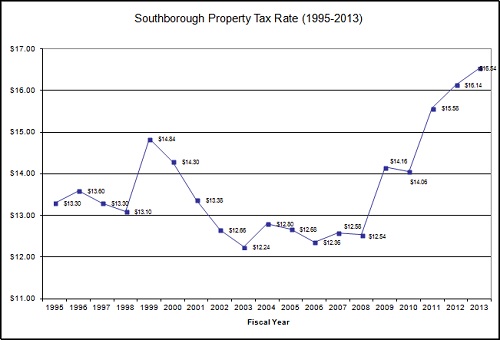

Click to enlarge

Southborough’s municipal budgets were approved at the Town Meeting in the spring. But our tax rate for this year (FY2014) has yet to be decided.

Each fall that the Board of Assessors recommends the rate for approval by Selectmen. Last year the increase was 2%, and 4% the previous year.

Recently, an anonymous comment indicated that Southborough’s ave. property tax bill increases since 2009 were below the state median. He said that a Globe article reported the town at about 9%, versus 13.5% median for the state.

Those figures apparently refer to the “average” bill. The actual tax rate for Southborough has increased by 17% since 2009, and 32% since 2008.

Carl Guyer recently proposed to split the rate (higher rate for commercial properties and lower for residents).

Proponents have pointed to the fact that commercial owners makes money off of their property. Opponents have noted that services for residents make up the bulk of the town’s expenses. They have especially decried unfairness to small businesses. Guyer posits that his evidence shows split rates in other towns haven’t hurt business growth. (You can read the debate in the comments under Guyer’s proposal.)

What are your thoughts? I’d love to hear from some voices new to the debate. (That doesn’t mean that I’m muffling the old ones.)

Which rate do you favor, single or split? Or do you have any new ideas for controlling the trending increase in property tax rates?

(Above chart provided by Susan Fitzgerald)

I agree with Carl. Split the tax rate.

Single rate and hold school budget to no more than 67% of the total budget. That would be a start.

Frank,

How do you hold th the shool budget? It is the driver of th tax rate.

To do that you would have to be tough when negotiating the school budget.

Teachers are becoming the high payed elite. They work fewer days and fewer hours.

Johnboy

Nothing will change until about 125 people vote NO at town meeting. That is the reality. For the last decade Town Meeting has basically rubber stamped whatever deal was reached between the Selectmen, Advisory, and the School Committees. The only exception I can recall in the last 10 years is the library where Town Meeting increased the budget.

Town leaders can reasonably infer that there is no real desire on the part of the electorate to control costs as long as they do not trigger a prop 2.5 override.

There is a disconnect here. If you are concerned about the increase in your taxes you have to do the following:

1. Go to Town Meeting with a bunch of people who feel like you do.

2. Vote NO on each budget.

3. Vote NO on any borrowing

4. Vote NO on any union contract that is ratified by Town Meeting (Teachers are not subject to this)

5. Vote NO on any Prop 2.5 override at TM and at the ballot.

If you vote YES or worse do not vote, then you are in effect agreeing to have your taxes raised. It will take some courage because you will not be able to hide behind anonymous names, your friends and neighbors will see how you vote. You will have to Stand And Be Counted.

Each and every registered voter has a voice at Town Meeting. It is a very open and fair forum. If you are bellyaching here and not going to Town Meeting and voting NO then you are wasting your energy. That is the only path to reduced taxes.

Al, you are right on all counts. I will never vote yes for any budget that includes a new teachers contract where we do not know the details and what we are told is not the complete truth (“we cannot disclose the details because it is not ratified”). If this were to happen again, then the whole budget should be voted down.

“Fool me once shame on you; fool me twice shame on me.”

Beth, I thank you for putting this story out there, as this is an issue that demands intelligent debate.

Mr. Rooney presented informative and compelling slides at town meeting in a presentation that should have caused everyone in town to take notice. The slides should be sent to every home in town.

I am very concerned. about a number of things. Our tax bills went from $4,000 in 2000 to $8,000 in 2010 without any increase in town services (in fact, one could argue a decrease in services during that time period). Our stabilization money went from over 3 million to the current $400,000. We don’t have any available money to rely on.

Town expenses are going to exceed town revenue next year. If everything else does not concern people, I would think that this point should. Where are we going to get the money if we don’t have any? Answer Tax increase. This means a possible proposition 2 1/2 override.

I am on a fixed income, am 74 years old and am barely able to stay in town as it is. These type of increases are going to force me out, which people don’t seem to care about as long as the schools keep getting increases. We will end up with the most expensive school system but without any senior citizens who built this town.

I think Carl Guyers recommendations are simply more tax and spend liberal democrat tactics. Leave the dog gone peoplpe alone who “work for a living”. They pay more than their fair share and we waont to take more to pay for unions, benifits, schools, et…. I dont own a business here or anywhere but I do have an LLC I recently formed. And let me kgive you all a clue. I am now paying double toatl taxes and benefits. I did this becasue I coudl not get a job in the marketplace so I turned to counsulting. Now I am making a living. I do know that many of the debt servicing that we have been doing for building schools is almost done. So taxes should be decreased, excess returned to the people, even is it is $100 each, it is our money. And we should totally un unionize the twon. if they dont like it fire them and re hire non union. Stand up tot he state and have Aldo represent us where he should in court to say we are not going to honor state and federal unfunded mandates. And work on a replacement team for the schools if the teachers unions threat and our School Board will not do what they are intenended to do, represent the tax payer not the teahcers unions. They di dit in Wisconsin folks and they won.

Split the rate…

as for the comment about the bill vs the rate, isn’t it the bill that matters?

I don’t have access to the data for “average” bills. (I haven’t even been able to find the graph you quoted since I don’t have that issue of the Globe and it didn’t come up in a boston.com search. Given the games people play with numbers and lack of knowledge of their source, I can’t say how valid the figures are.)

If you are a resident in Southborough who hasn’t moved since 2008/9, and your home’s appraised value didn’t decrease, then what matters to your wallet is the rate changes. (If your appraised value was lowered significantly – then, yes the bill is what matters.)

I agree with Southsider, the rate or the assessment value doesn’t hurt my wallet…it is the bill.

http://www.boston.com/yourtown/specials/snapshot/massachusetts_snapshot_property_taxes_2009_2013/

Thank you. This was what I had asked you for last week. I couldn’t find it.

I always attend.

Let’s get one thing straight. Teachers are not the high payed elite. Yes, they have a pension. But they also make a fraction of what many others make so there are tradeoffs. If you all disagree, I think you may want to consider a career change and jump into the lucrative business of teaching.

For all the discussion about school budgets, let’s remember one thing. The quality of schools drives real estate values in the community. I understand this hurts people living on fixed incomes since they have difficulties paying increased taxes. But again, that is a tradeoff. You have a higher home value but pay higher taxes.

The split tax rate idea seems to have some merits to it. Decreasing tax rates for people living in the town (and using the services of the town) which could stimulate more demand for businesses in the town. If citizens have more disposable income to spend, the commercial businesses could see more business. Many of the local businesses are unlikely to leave anyway since they have a customer base and the impact to their business wouldn’t be that significant in my opinion. They have the ability to adjust their pricing to lessen the impact.

Good teachers should be paid well.

In the last few years the average teacher’s salary has gone from $70K to $80K far out pacing the private sector during the worst recession since WW2. There is no recovery no matter what set of lies come from Washington.

No parant should here the words “we are sorry but that is not in the contract” when make simple professional requests in the education of their child.

No one associated with the school system has ever explained why our school costs per child are higher then Shrewsbury. Yes, I could live in Shrewsbury, but if I am selling the house I am moving to a lower tax state.

If I felt the School Committee was representing the tax payer rather then the educational establishment, I would probably feel different. Hard choices need to be made and it starts with that small group of individuals.

If I can make it to TM (making just above the teacher’s average salary requires nights from home), I will be voting no on any future budget where tough school budget choices are not being made. Champaign budgets need to be reduced to a really good craft beer budget.

Resident:

Nothing I am about to say should be interpreted as disrespectful of teachers or teachers. Teaching is vital, and hard work when done well.

Here are the facts:

1. The average teachers salary in our K-8 system 1n 2011 was $75,961 vs a state average of $70,340. No more current data is available but given that we have a history of 7+% increases in average salary that would make the average for the year ending June 2013 about $86,967. Teachers work about 200 days per year vs an average of 235 (3 weeks vacation, 10 holidays) for a private sector worker. Correcting for full time equivalence that comes out to about $102,400. http://profiles.doe.mass.edu/profiles/teacher.aspx?orgcode=02760000&orgtypecode=5&leftNavId=815&

2. The corresponding numbers for Algonquin are $86,330 vs a state average of $70,340. My estimate for the year ending June ’13 is $98,839 and the full time equivalent estimate is $116,482. http://profiles.doe.mass.edu/profiles/teacher.aspx?orgcode=07300000&orgtypecode=5&leftNavId=815&

3. Teachers have defined benefit pension plans that the qualify for after 10 years of service.

4. With a minimum of 10 years of service a teacher may retire as early as age 55.

5. Teachers receive health care benefits in retirement.

6. Teachers do contribute a portion of their income towards their retirement but the vast majority of retirement benefits are funded by the tax payers.

These are the facts.

As to the dual rate, a very strong case can be made for a dual rate where businesses pay about 1/3 the rate that a residence pays because they use so much fewer public resources.

The argument that local businesses will just pass the increase along to their customers means that we will pay in the end. The real concern is that we have a lot of business in town that is not “local” they have a choice of where to locate. We have some big sophisticated companies that keep close track of taxes and they have a choice when their leases are up or they decide to expand (or contract). Mass is already a low growth state we should keep Southborough a business friendly environment to encourage businesses to move here not leave.

If we want a service we should be willing to pay for it.