Above: Advisory’s letter/report to Town Meeting defends the recommended budget, includes a warning about a future challenge, and shares its plans for working to improve the financial situation. (images edited from report.)

The Advisory Committee asked me to share with readers its report/letter to voters for Monday night’s Annual Town Meeting.

For each Annual Town Meeting, the Southborough Advisory Committee is required to submit a report to meeting voters. It includes their recommendation for the Town Budget and other spending Articles. (They also opine on other Articles on the Warrant.)

Click here to read the full report. Below is my summary of the highlights.

FY26 Budgets and Taxes

This year’s report explains why the committee supports what will amount to a much higher tax increase than they would like. (Though, the good news is that the updated figure is slightly lower than the version that had been posted to the Town’s website.)

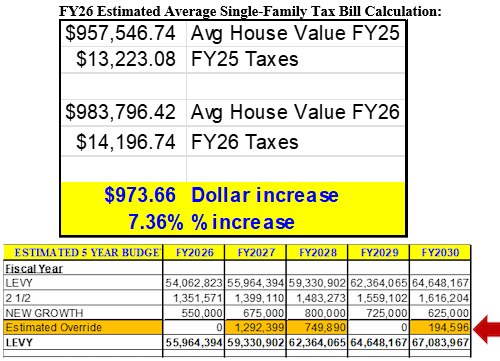

The updated figures estimate a 7.36% tax increase for the average homeowner. That is down from the previous projection of 7.47%. But Advisory stresses that this is an estimate based on projected property valuations that aren’t complete 1 and other outside factors beyond Town Meeting’s votes.

Advisory’s Chair Andrew Pfaff tells me that the updated projection doesn’t represent any changes to what Town Meeting will be voting on for budgets and capital expenses.2

For the FY26 budget, Advisory details:

The Advisory recommended budget is expected to increase the tax rate to $14.43 per $1,000 from the current $13.81 per $1,000. The projected tax increase on the estimated mean value of a Southborough house on 1/1/25 ($983,796) is expected to be approximately $974 (or about $243 per quarterly tax bill). . .

Our goal is to keep the budget increase at or below inflation. We tried hard to do that this year, but in the current inflationary environment, we didn’t achieve that goal.

The report highlights the challenges of keeping costs low without sacrificing service to residents. It points to cost drivers of Collective Bargaining Agreements with union employees, spikes in health insurance costs for personnel and school bus transportation contracts.

Other factors include payments on debts for previously approved costs, specifically the fire ladder truck and cleaning up the Breakneck Hill farm dump.

Notably, no specific mention is made of the proposed increase in police department staffing that is embedded in the recommended budget. It’s a plan and expense that individual members debated, but the majority of the committee appeared to support.

Last night, meeting for the first time since then, Advisory approved the report.3

Warning about next year

The report also highlights the “Likely future Proposition 2 ½ Tax Levy Override and Budget Forecast“. This is a separate override than the one on the ballot this May. (That would be to allow the Neary School Building Project.)

The report also highlights the “Likely future Proposition 2 ½ Tax Levy Override and Budget Forecast“. This is a separate override than the one on the ballot this May. (That would be to allow the Neary School Building Project.)

Advisory is warning about the potential need for another vote next year, simply to maintain Town services and staffing in FY27 and beyond:

We have seen a significant increase in expenses versus revenue this year, which is causing the town’s excess levy capacity to be reduced much more year-over-year than it has in the past. Furthermore, the inclusion of a significant amount of one-time funding (ARPA, Free Cash) in prior year’s budgets has resulted in an accelerated reduction of our excess levy capacity, thereby exacerbating the challenge in the future. This is a worrisome trend and is critical for all taxpayers to understand. Most likely the town will have to seek a levy limit override at the ballot box next year to avoid having to reduce town services or staffing. The town has not had to have an override since 2006. We are currently forecasting a $1,292,399 levy capacity shortfall in FY27.

The report wasn’t all doom and gloom. The committee shared its perspective on Long Term Planning, including work it is doing to try to improve the Town’s future financial position. (Scroll down for that.)

Opining on Other Articles on the Town Warrant

Advisory shared its unanimous positions on four Articles on the Warrant.

Advisory supports the Capital Budget Article (#14) to borrow for a list of “critical and important capital items for the town”.

The Committee voted to “Not Support” Articles 28 & 29 for ADU Bylaw revisions. They described the proposed zoning update as “overly complex and too restrictive.”

And, despite specifying the impact of Breakneck Hill remediation debt service on Town taxes, Advisory opposes the Citizen Petition Article (#37) to hire Counsel to investigate the farm dump situation. They argue against spending more money for something they believe has been shown couldn’t recoup expenses.

(The Committee also again opined against a “concerning trend” of residents bringing Citizen Petition Articles on topics they believe should be addressed “outside of a Town Meeting, especially ones that are “advisory” like this one is.)

Long Term Planning

The report covers the committee’s thinking and strategy looking forward. It includes potential future recommendations to increase the local meals and lodging taxes and implement stormwater usage fees. They will also be working with other officials on improving financial processes and practices:

There are several areas worthy of ongoing attention besides Advisory’s continual work on our annual town budget. These include (i) the Town’s unfunded pension and healthcare liabilities (in the tens of millions of dollars but we are starting to make progress); (ii) the need for infrastructure investment (also in the tens of millions of dollars – hence the appointment of the Capital Improvement Planning Committee); (iii) the decision whether or not to close one of the four K-8 schools and if so, how to re-purpose the closed school; (iv) the impact of State or Federal unfunded mandates; (v) how to find additional sources of non-real estate tax revenue to help ease the burden on the property tax payers. These issues and others all deserve careful attention and planning, and Advisory will continue to address them.

On the topic of sources of non-real estate tax revenue, one such additional source of revenue is the optional local meals tax, that was passed at the May 2021 ATM and became operative on 1/1/2022. We received $124,718 for FY24 and $82,725 for the first three quarters of this fiscal year and expect the last quarter of the year to be similar, which is a great additional revenue stream for the town. Advisory advocated for this local option meals tax as a means to increase local revenue outside of the tax levy. In addition, the current proposal of Governor Healey’s Municipal Empowerment Act, which we hope will pass, would provide an option that allows cities and towns to further increase local option meals taxes from .75% to 1%. This is something that the Advisory Committee has on its list of items to research further, in order to see if we would support bringing it to Town Meeting for approval in the future. The new Empowerment Act, in addition to the meals tax increase, also allows for increasing the local lodging tax ceiling from 6% to 7% and adding a new 5 percent local option Motor Vehicle Excise surcharge. Both are items that we will discuss during our summer meetings.

Another revenue opportunity that Advisory is in the process of researching is the potential to adopt a stormwater usage fee and associated enterprise fund, which would move the costs associated with stormwater management in the town from the general fund to an enterprise fund. That funds expenses would then be assessed to all residents of town by percentage of total impervious surface. This method has been implemented in multiple Massachusetts towns and is quite common elsewhere in the country. This would most likely shift some of the burden of these costs from the residential tax base to the commercial and non-profits in town that have larger amounts of impervious surfaces (buildings, parking lots, other non-porous surfaces).

As part of the Town’s long-term financial planning and improvements, the Select Board, by request and in support of Advisory, asked for a financial policy and overall financial management review of the town. The State Department of Revenue (DOR) provides this service at no charge to assist communities with their financial management practices. The evaluation is a comprehensive operational review of local accounting, treasury, collection, assessing, and overall administrative functions. It is designed to improve day-to-day management practices and procedures through specific hands-on tools, guidance, and strategies for improving local government. The financial policy review provides guidance in formalizing the town’s existing financial processes and adopting best practices to better govern town operations. Based on the reports received, the process of updating some of the policy recommendations has begun and will continue, with more proposed changes coming. In addition, we are reviewing the financial management review document and putting together some recommendations to be implemented in the town.

- In the past, unexpected differences between the increase in residential property values vs commercial values has forced the Town to raise taxes more than projected. I’ve been told that the Town’s calculations assume a 2% value shift this year.

- The biggest factor for that change appears to be correcting the expected “new growth” (from new construction). That decreased the burden for existing properties to cover the levy that needs to be raised. The assessed average home value was also updated to be slightly lower.

- The video of the hybrid meeting didn’t pick up what the committee briefly discussed before voting to amend and approve the letter. (Others in the room were chatting following the end of a joint meeting that had focused on the Neary Building Project.)